car sales tax illinois vs wisconsin

Cost of Buying a. Gas prices and maintenance fees are lower than most states.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Purchases of food clothing movie tickets cars and so on will cost you more in sales tax in Illinois than in Indiana.

. The vehicle identification number VIN. With typical annual gas costs around 1500 in the state however Oregon residents should plan to pay more at the pump or find ways to save money on gas. The sales tax in Chicago is 875 percent.

In most states you pay sales tax on the monthly lease payment not the price of the car. Purchase prices are higher than in North Carolina and Missouri. For vehicles that are being rented or leased see see taxation of leases and rentals.

Car tax as listed. It seems simple. Milwaukee is at least 21 cheaper overall than the other three cities in overall cost of living.

Since the Missouri tax appears to be 4225 and the standard Illinois tax on vehicle sales is 625 you must pay the 2025 difference. With local taxes the total sales tax rate is between 5000 and 5500. Imagine that your monthly lease payment is 500 and your states sales tax on a leased car.

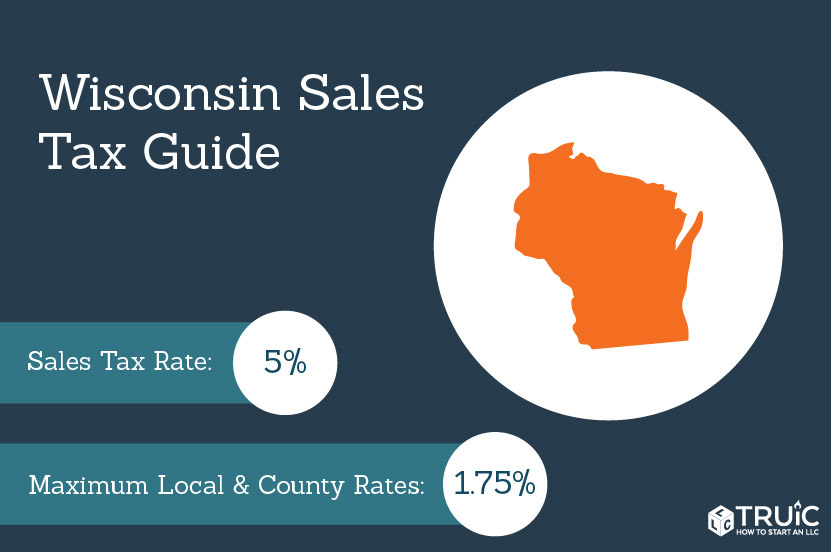

Wisconsin collects a 5 state sales tax rate on the purchase of all vehicles. Some dealerships also have the option to charge a dealer service fee of 99 dollars. The state sales tax rate in Wisconsin is 5000.

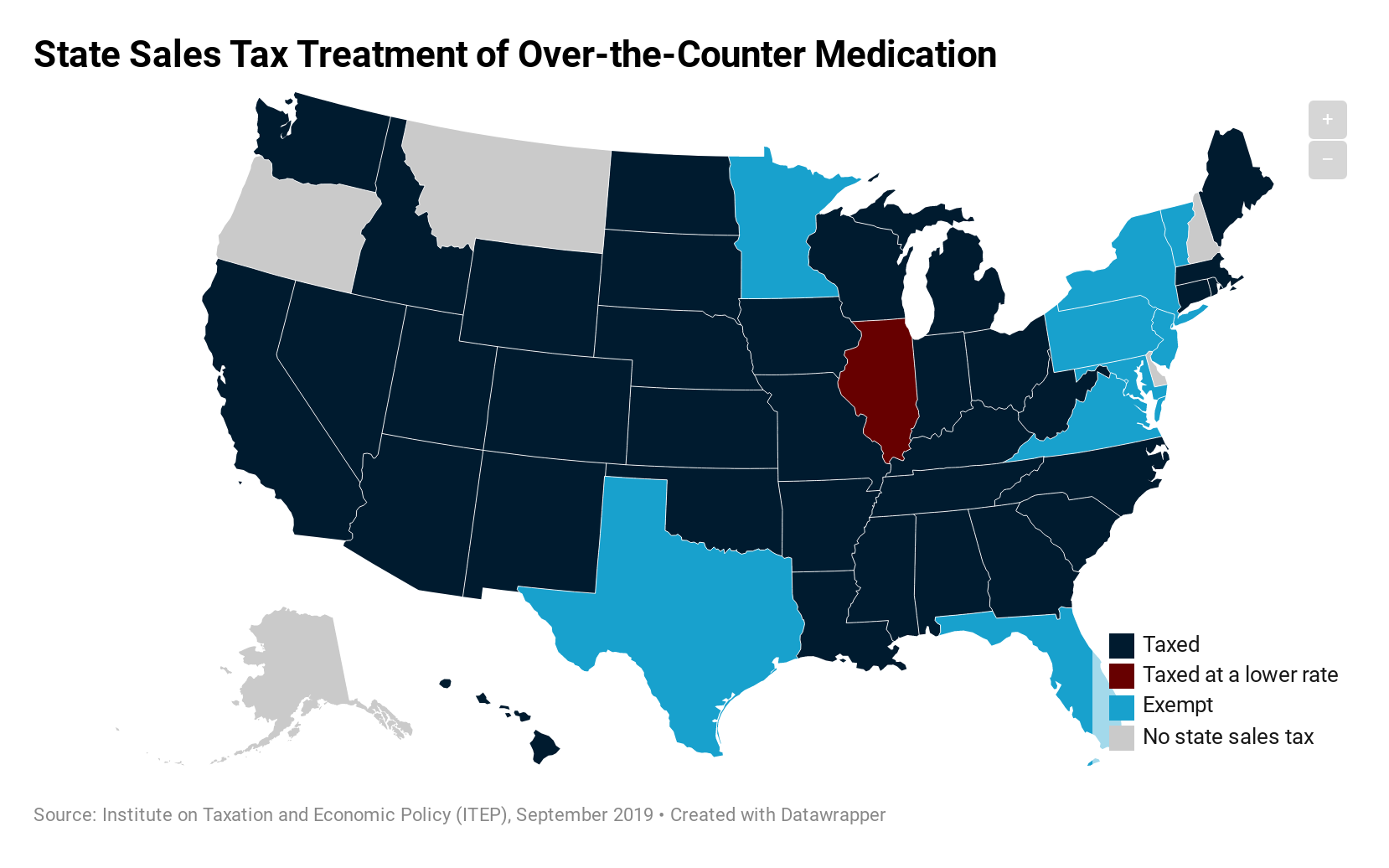

Go to a county where the tax rate is the lowest. There is also between a 025 and 075 when it comes to county tax. Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

That way you dont have to deal with the fuss of trying to follow each states. The statewide sales tax rate is 625 collected by the Illinois Department of Revenue with 125 being returned to local governments where the goods were purchased. Insurance premiums are the second lowest in the country.

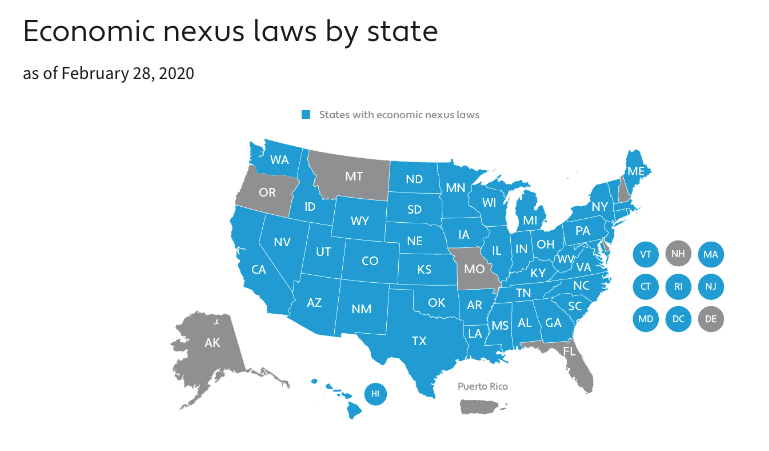

With local taxes the total sales tax rate is between 6250 and 11000. Typically when you buy a car in a different state than your home state the car dealer collects your sales tax at the time of purchase and sends it to your home states relevant agency. However if a vehicle purchased in another state the District of Columbia or the Commonwealth of Puerto Rico is subject to sales tax in.

The car dealer will follow the sales tax collection laws of their own state. 2284 138 percent of the average sales price. Thats 2025 per 1000.

Actual tax rates throughout the state vary because in addition to state taxes the several local taxing bodies that follow the state tax structure have imposed. If you had the vehicle titled in another state for more than three months no Illinois tax is due but you still must file Form RUT-25 to reflect that fact. In addition to state and county tax the City of Chicago has a 125 sales tax.

Food utilities and other indexes are factored into this score. 2297 139 percent of the average sales price. In fact Illinois has one of the highest property tax rates in the whole country.

The date the vehicle entered or will enter the state you plan to register it in. While its true that Illinoiss state sales tax of 625 is lower than Indianas state sales tax of 7 its also true that many cities and counties assess their. Illinois has recent rate changes Wed Jul 01 2020.

Form RUT-50 Private Party Vehicle Use Tax Transaction Return. There are also county taxes of up to 05 and a stadium tax of up to 01. United States vehicle sales tax varies by state and often by counties cities municipalities and localities within each state.

Sales tax for a leased vehicle is calculated based on the states tax percentage and the cost of the lease payments. Select the Wisconsin city from the list of popular cities below to see its current sales tax rate. Unless of course you reside in those Metro-East communities with a 65 tax on vehicle sales.

Livability Score Out of 100 Milwaukee - 56. With local taxes the total sales tax rate is between 6250 and 11000. In Cook County outside of Chicago its.

View chart listing combined. Wisconsin is one of the cheapest states to buy a car. Wisconsin has recent rate changes Wed Apr 01 2020.

The state sales tax rate in Illinois is 6250. You must pay sales tax when you lease a car. If you try to register the car in Illinois youll have to pay use tax at the time of registration on the difference between the sales tax paid to the state where you purchased and the Illinois rate generally 625 but higher in the collar counties.

The make model and year of your vehicle. 625 local 125 more in Chicago total. Form RUT-50 Private Party Vehicle Use Tax Transaction Return due no later than 30 days after the purchase date of the vehicle.

Then the difference is. Car sales tax rate is 575 which is slightly higher than other states. Oregon has no car sales tax which means car buyers only have to cover a 77 title fee -- altogether paying 1656 less than the national average cost of sales tax plus title fee.

AUTO INSURANCE PREMIUMS FOR FULL COVERAGE IN ILLINOIS vs. A motor vehicle purchased out of state and titled and registered in Wisconsin is subject to Wisconsin sales or use tax in the same manner as a vehicle purchased in Wisconsin unless an exemption applies. Form RUT-50 is generally obtained when you license and title your vehicle at the local drivers license facility or currency exchange.

Form ST-556 Sales Tax Transaction Return. Read our guide to car insurance in Illinois versus Wisconsin and take the strain out of your move. The date that you purchased or plan to purchase the vehicle.

The information you may need to enter into the tax and tag calculators may include. If you need to obtain the forms prior to registering the vehicle send us an email request or call our 24-hour Forms Order Line at 1 800 356-6302. Sales taxes in Illinois are calculated before rebates are applied so the buyer who pays 9500 after a 2500 rebate will still pay sales tax on the full 12000.

2061 125 percent of the average sales price. Housing is the biggest factor in the difference.

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Taxes In The United States Wikiwand

Amazon Sales Tax For Sellers In 2021

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Sales Taxes In The United States Wikiwand

What S The Car Sales Tax In Each State Find The Best Car Price

What Is Illinois Car Sales Tax

Illinois Used Car Taxes And Fees

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Beginner S Guide To Dropshipping Sales Tax Blog Printful

Illinois Sales Tax Credit Cap Important Information

What S The Car Sales Tax In Each State Find The Best Car Price

Wisconsin Sales Tax Small Business Guide Truic

States With Highest And Lowest Sales Tax Rates

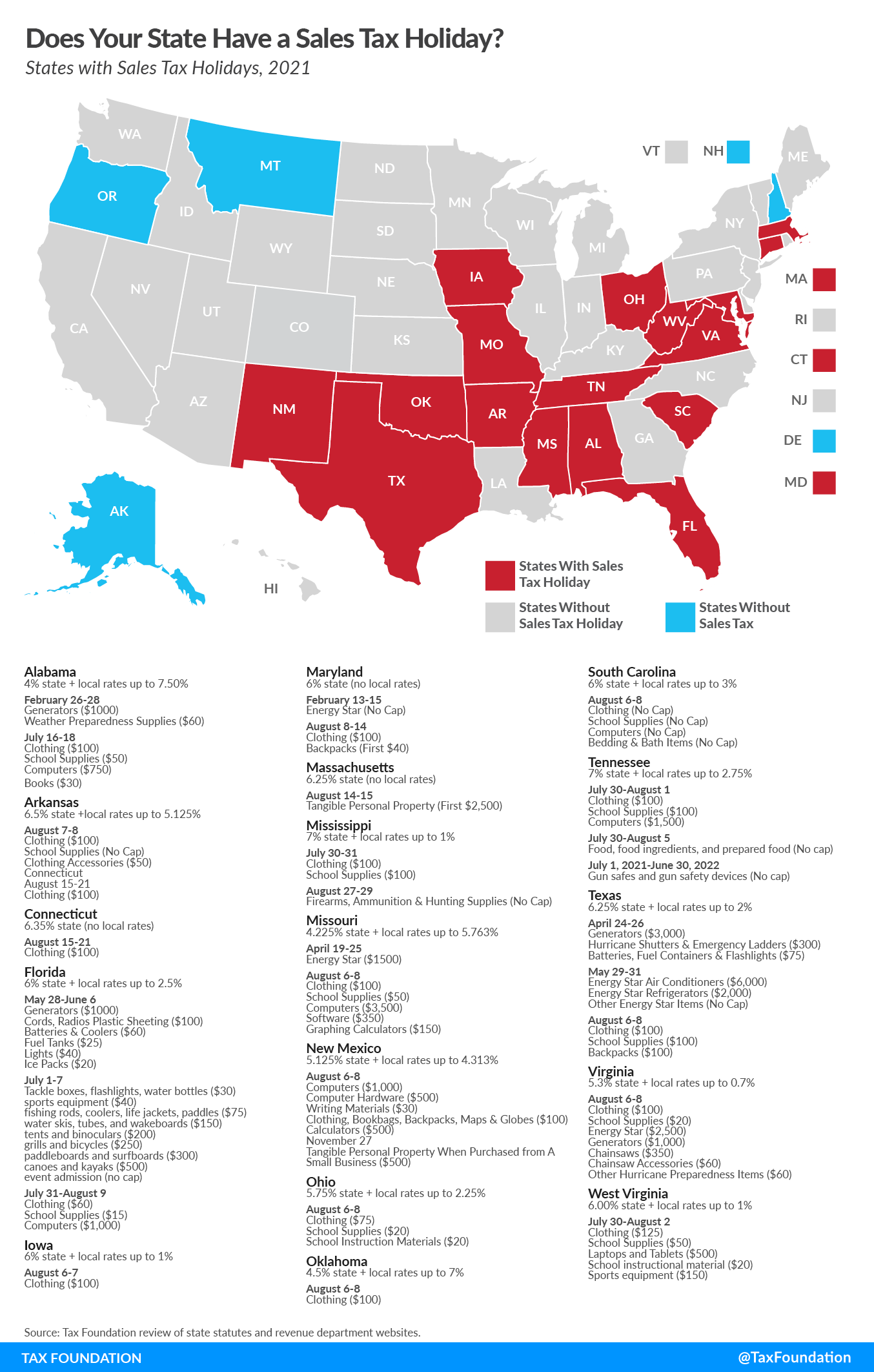

Sales Tax Holidays Politically Expedient But Poor Tax Policy